2024 Forecast: The AI Revolution in Fintech

Over the last few years, we have witnessed the transformation of AI-based solutions in fintech industry from experiments and prototypes to full-fledged business applications. However, this year may be a breakthrough.

AI to help fintechs compete with banks

Started a month ago A.D. 2024 will likely be the year when AI begins to completely transform the financial industry, introducing personalization at an unprecedented level. Predictive systems will be able to assess a customer's creditworthiness with increasing precision using unstructured data, emotion analysis, and reinforcement learning. As a result, we will experience an increase in the availability of financial services and, at the same time, their optimization to the individual needs of the user. This trend will certainly continue this year.

Huge changes are likely to occur in process automation and operational efficiency. AI algorithms will be able to automatically recognize and process complex financial applications with increasing precision, reducing the burden on employees and the risk of human errors. This will also open the door for small businesses to compete with large financial institutions. This will be a gigantic opportunity for many fintechs and financial projects that are already challenging traditional financial institutions en masse and are increasingly boldly reaching for their piece of the financial pie.

Synthetic brains in the service of fintech

The real game changer for the industry may be neuromorphic processors, often described as "synthetic brains" - i.e. systems inspired by the human brain that have the potential to change the rules of the game in the field of machine learning.

They are distinguished by their ability to process information in a more energy-efficient manner, using complex connection systems that actually function similarly to synapses. This unique design allows for data processing and learning at high speed and minimal energy consumption, which is crucial for mobile fintech applications where response time and reliability are as important as cost-effectiveness.

This is the moment when artificial intelligence ceases to be just a software function and becomes something bigger - an architecture that mimics our own neurology.

One of the most exciting applications of neuromorphic processors in fintech is their ability to detect and respond to fraud in real-time. Thanks to their ultra-high processing power, these systems can analyze irregularities in financial transactions on an unprecedented scale. Moreover, as machine learning becomes more advanced, neuromorphic processors will be able to predict new types of fraud before they have a chance to become widespread.

Data safety first

However, the development of AI also poses certain threats to fintech entities. The issue of data security is certainly at the top of this list. Fintechs will probably often have to face questions about "How do you protect customer information when algorithms analyze it in the cloud?"

When it comes to cloud data processing, fintech companies will have to focus on transparency and data management principles, including: will have to clearly define what data is processed, how it is protected and who has access to it. An important direction of development will certainly be the "Privacy by Design" and "Security by Design" technologies, which from the very beginning implement security measures at every stage of financial product development. In 2024, using the Zero Trust model - "never trust, always verify" - will become the industry standard, regardless of the location of data (whether on-premise or in the cloud).

Fintechs will probably often have to face questions about "How do you protect customer information when algorithms analyze it in the cloud?"

Cyberattacks

As the fintech industry developed at an unprecedented pace, criminals' keen eyes turned to modern technologies and systems that have become the lifeblood of global finance. In 2024, the scenario of intensified cyberattacks will certainly not be just a dystopian vision, but will become commonplace. Today's cybercrime no longer resembles the simple phishing schemes of years ago. Fully automated and self-learning algorithms using artificial intelligence conduct coordinated attacks that can disable even the most secured financial systems.

This year, fintechs will pay more attention to new solutions, such as behavioral biometrics or quantum cryptography, which may be a response to increasingly sophisticated attacks. The dynamic progress of legal regulations will strengthen the defense against cyberattacks worldwide.

Legal regulations

And speaking of regulations, they will certainly be one of the biggest challenges the sector will have to face. The fintech industry realizes that legislation around the world must keep up with the pace of technology development and is often a barrier to innovation. Employee competencies are also of key importance - the industry needs specialists with an understanding of AI who are able to manage its proper implementation.

It is highly probable that in 2024 we will find out whether AI and fintech are like a developing organism - dynamic, full of potential, but requiring appropriate conditions for development, or rather the opposite. For the industry, investors and users, the key to success is finding a balance between innovation and responsibility. With the right approach, the possibilities are virtually endless, and finance as we know it today can become almost unknown tomorrow. Although challenges exist, with appropriate preparation and regulations, the world of fintech with AI in the main role has everything needed to rewrite the future.

The shift to cloud in financial institutions: everything you wanted to know

In recent years, traditional financial institutions have been undergoing a significant transformation by transitioning their operations to the cloud. This shift is driven by several key factors and is reshaping the way banking and financial services are delivered.

Reasons for the Shift

Several compelling reasons are driving traditional financial institutions to move their operations to the cloud. Firstly, cost efficiency plays a crucial role. Cloud-based solutions eliminate the need for extensive physical infrastructure and reduce maintenance expenses. This cost-saving aspect is particularly appealing to financial organizations seeking to optimize their operational expenses.

Another key motivator is scalability and flexibility. Cloud infrastructure allows banks to scale their resources up or down based on fluctuating demands. This adaptability ensures optimal performance during peak usage periods and cost savings during less busy times. It's a critical aspect in an industry where operational efficiency is paramount.

Additionally, cloud adoption accelerates innovation. Financial institutions must keep pace with rapidly evolving customer expectations and emerging technologies. Cloud-based solutions provide a platform for the swift deployment of new services and technologies, allowing banks to stay competitive and meet the changing needs of their customers. This agility is a game-changer in the financial services landscape.

Lastly, we shouldn't also forget about the psychological pressure that often weighs on decision-makers due to the direction and pace of changes occurring in the market. After all, they also observe the market and notice the changes in their surroundings. Regardless of their personal feelings about moving to the cloud, they undoubtedly perceive the directions of change and wonder whether they will be in the right place and time. Since the entire world is moving to the cloud, does it not concern us as well?

Since the entire world is moving to the cloud, does it not concern us as well?

The implementation process

The transition to the cloud involves a series of steps. Financial institutions begin by selecting cloud providers and services that best align with their specific needs and regulatory requirements. The migration process includes transferring data and applications to the cloud infrastructure. It also necessitates adjustments to operational procedures and workflows to align with the cloud environment. From our perspective- as cloud banking system provider - the most rational step is to move less critical services to the cloud and confirm its validity from both technical and business perspectives. This allows for mitigating the risk associated with such a significant change.

Benefits of cloud adoption

Moving to the cloud offers numerous advantages for financial institutions:

![]() Enhanced scalability and agility: Cloud-based infrastructure offers the ability to seamlessly scale resources up or down to meet fluctuating demands, enabling financial institutions to adapt quickly to changing market conditions and customer needs.

Enhanced scalability and agility: Cloud-based infrastructure offers the ability to seamlessly scale resources up or down to meet fluctuating demands, enabling financial institutions to adapt quickly to changing market conditions and customer needs.

![]() Speed of deployment: New features, services, and updates can be rolled out rapidly, allowing financial institutions to stay ahead of the competition and respond swiftly to market changes.

Speed of deployment: New features, services, and updates can be rolled out rapidly, allowing financial institutions to stay ahead of the competition and respond swiftly to market changes.

![]() Reduced costs: Cloud computing can significantly lower IT infrastructure costs by eliminating the need for on-premises hardware and software maintenance. Financial institutions can also optimize cloud spending through various cost optimization strategies

Reduced costs: Cloud computing can significantly lower IT infrastructure costs by eliminating the need for on-premises hardware and software maintenance. Financial institutions can also optimize cloud spending through various cost optimization strategies

![]() Improved security: Cloud providers invest heavily in security measures, providing a robust and secure environment for financial institutions to store and manage sensitive customer data.

Improved security: Cloud providers invest heavily in security measures, providing a robust and secure environment for financial institutions to store and manage sensitive customer data.

![]() Accelerated innovation: Cloud adoption facilitates faster innovation cycles, enabling financial institutions to quickly develop and deploy new products and services to meet evolving customer expectations.

Accelerated innovation: Cloud adoption facilitates faster innovation cycles, enabling financial institutions to quickly develop and deploy new products and services to meet evolving customer expectations.

Modernizing core systems is essential to achieving the flexibility, efficiency, and innovation required in delivering financial services in a cloud-native environment.

The role of core banking systems

Core banking systems are at the heart of financial institutions' operations, and their role in the transition to the cloud is pivotal. Due to the critical importance of such solutions in the financial institution's operations, core systems are often planned to be the last to migrate to the cloud. Nevertheless, modernizing these systems is essential to achieving the flexibility, efficiency, and innovation required in delivering financial services in a cloud-native environment. Cloud-native core banking solutions offer greater agility, enabling banks to introduce new products and services more rapidly. They also enhance scalability, ensuring that the core banking infrastructure can adapt to varying workloads.

The shift to the cloud in traditional financial institutions is driven by the pursuit of cost efficiency, scalability, flexibility, and innovation. While it presents significant advantages, addressing security concerns and managing vendor dependence are critical aspects of this transformation. Additionally, the modernization of core banking systems plays a central role in enabling financial institutions to fully harness the benefits of the cloud and meet the evolving demands of the industry.

The rise of BNPL: transforming the way we shop (and how BOS helps with it)

Buy Now, Pay Later (BNPL) services have emerged as a dynamic and continually evolving financial offering, reshaping the way consumers manage their payments. Over the past few years, the BNPL landscape has witnessed remarkable growth and innovation, leading to a surge in popularity among consumers and businesses alike. In this article, we will delve into the evolution of BNPL, highlighting its sustained development and exploring the role of fundamental software solutions like BOS in the creation of innovative financial products.

BNPL, or "buy now, pay later," is a type of loan that allows consumers to make purchases with deferred payment. Under this arrangement, the consumer receives the goods or services immediately or spreads the repayment over installments, usually at no additional cost.

BNPL started to gain significant traction in Europe during the early 2010s. The fastest growth occurred during the Covid-19 pandemic in 2020 and the trend continues. According to GlobalData, the European BNPL market alone was worth €155.79 billion in 2023 and is expected to grow to €300 billion by 2025.

BNPL is particularly popular among young consumers who value the convenience and flexibility of this solution. According to research by Kearney, in 2023 in Europe, over half (57%) of consumers aged 18-34 used BNPL.

One of the notable advantages of BNPL is that it empowers young individuals on their path to financial independence, especially when they may not yet have substantial savings but face significant purchasing needs. This flexibility offered by BNPL allows them to make essential purchases, whether it's for education, setting up a home, or acquiring necessary items, without the immediate burden of a full upfront payment. By enabling responsible spending and budget management, BNPL serves as a valuable tool for young people navigating their financial journey.

The European BNPL market is expected to grow to €300 billion by 2025.

BNPL is mostly used for purchases in categories such as:

![]() fashion,

fashion,

![]() electronics,

electronics,

![]() services.

services.

Further places also included:

![]() Home Furnishings - BNPL is often utilized for purchasing furniture, home decor, and appliances;

Home Furnishings - BNPL is often utilized for purchasing furniture, home decor, and appliances;

![]() Beauty and Cosmetics - many users opt for BNPL when buying skincare, makeup, and beauty products;

Beauty and Cosmetics - many users opt for BNPL when buying skincare, makeup, and beauty products;

![]() Travel: some BNPL services allow users to finance plane tickets and travel expenses.

Travel: some BNPL services allow users to finance plane tickets and travel expenses.

The Buy Now, Pay Later (BNPL) market in Europe is experiencing remarkable growth, poised to become a €300 billion industry by 2025, according to projections by Deloitte. This rapid expansion is driven by:

![]() increased popularity of online shopping,

increased popularity of online shopping,

![]() a growing group of young consumers who value the convenience and flexibility of BNPL,

a growing group of young consumers who value the convenience and flexibility of BNPL,

![]() technology developments that enable BNPL integration with an increasing number of e-commerce platforms.

technology developments that enable BNPL integration with an increasing number of e-commerce platforms.

It is no wonder that with the growing popularity of BNPL solutions, there is also an increasing growth in IT systems offering tools for creating and managing BNPL solutions. One of such solutions available on the market is BOS - a fully flexible and cloud-native system. BOS incorporates a BNPL module allowing for the creation of credit products with deferred payment. Notable features include:

![]() deferred payments within limits granted by the bank,

deferred payments within limits granted by the bank,

![]() application to current and previous purchases,

application to current and previous purchases,

![]() flexibility in linking to existing accounts or as a separate product.

flexibility in linking to existing accounts or as a separate product.

BOS system incorporates a BNPL module allowing for the creation of credit products with deferred payment.

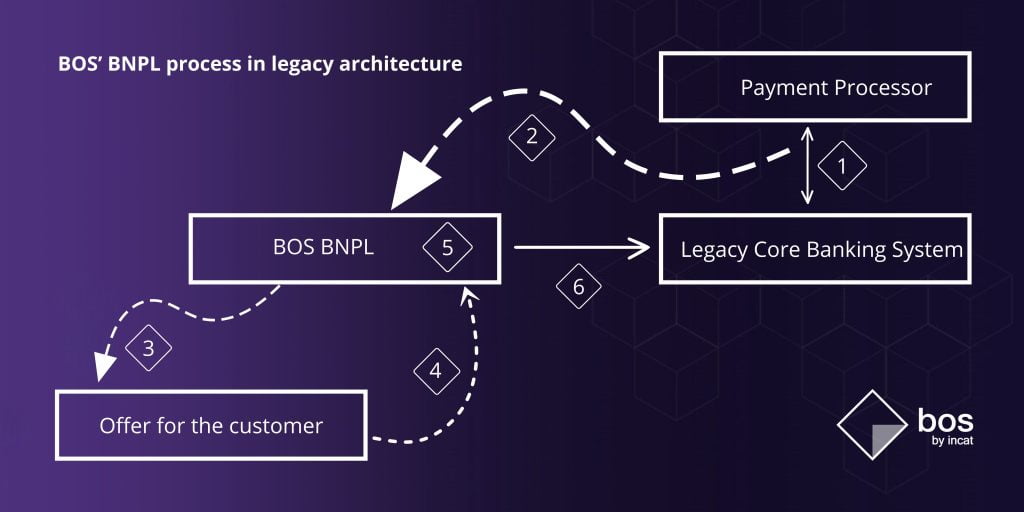

The BNPL process within BOS comprises six well-defined steps, ensuring a seamless experience for both consumers and businesses: Steps include:

1) transaction authorization,

2) verification for deferral eligibility,

3) offer presentation,

4) client acceptance,

5) micro-loan creation,

6) account funding.

The whole process looks like in the picture below:

Efficiency Consideration

While Banking Legacy Systems adeptly accommodates BNPL functionality, the question is whether BNPL should exist as a separate system arises. It’s crucial to clarify that when referring to a separate system, it pertains to a dedicated platform specifically designed for managing the intricacies of BNPL services. This is distinct from the main transactional banking system, BOS, and even more so from traditional Banking Legacy Systems.

Benefits of a Separate System for BNPL

![]() Scalability

Scalability

A dedicated BNPL system allows for focused scalability, efficiently handling the growing volume and complexity of BNPL transactions.

![]() Specialized Handling

Specialized Handling

BNPL systems can cater specifically to the unique characteristics of deferred payments, dynamic calculations, and the nuanced nature of BNPL services.

![]() Optimal Performance

Optimal Performance

Separation ensures that the BNPL system operates optimally, avoiding potential conflicts or constraints within broader banking systems.

![]() Streamlined Processes

Streamlined Processes

BNPL-centric platforms can streamline processes, enhancing efficiency and responsiveness to the evolving demands of the BNPL landscape.

***

If you want to learn more about what the BNPL solution in the BOS system offers, click the link or contact us in order to schedule a demo of the solution.

Game changer in banking: the secrets of Event-Driven Architecture

In the ever-evolving landscape of modern banking, today’s core banking systems are designed to offer a comprehensive suite of cutting-edge solutions. Market leaders most often use microservice architecture, offer the possibility of installation on any cloud and integration via API, they also use open-source solutions, which allows for cost optimization.

However, amidst this myriad of technological advancements, one architectural paradigm stands out as a transformative force: Event-Driven Architecture (EDA). In the following article, we will look at the use of event – driven architecture in the BOS system.

What is EDA and what are its characteristics?

Event-driven architecture (EDA) is a design pattern that emphasizes the flow of events or messages between various components of a system. In the context of core banking systems, EDA allows banks to process transactions and customer interactions in real time, as opposed to the traditional batch processing model. The key characteristics of EDA in core banking systems are:

![]() Flexibility

Flexibility

Core banking systems using EDA can respond quickly to regulatory changes and market demands. Components can be updated independently, reducing downtime and risk.

![]() Scalability

Scalability

EDA facilitates easy scalability by decoupling components. New services can be added without disrupting the existing architecture, making it more adaptable to changing business needs.

![]() Asynchronous Communication

Asynchronous Communication

EDA enables asynchronous communication between different components of the system. Events are generated and sent to specific handlers when an action or state change occurs, allowing for real-time processing without waiting for a response.

EDA in BOS system – what does it mean?

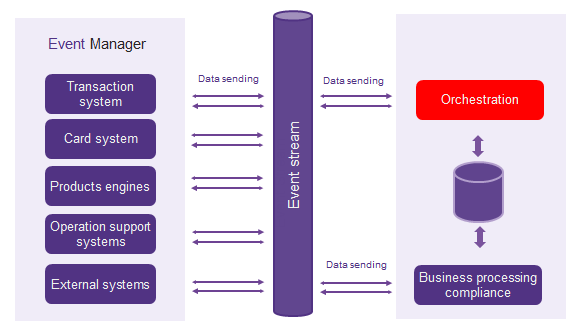

In BOS, communication between system components is based on events related to the customer’s activity and events generated by business components. In other words, every activity is an event. Every card transaction, every bank transfer (initiated or received by a customer), every loan application submitted is an event. An event is also any activity initiated by the system, such as collecting a fee or generating a monthly statement.

And that’s not all, as events reach beyond financials: every time a mobile app is open also constitutes an event. So does logging in to your online banking system.

And what does it look like in practice? Imagine that your customer has just paid over $2000 in a consumer electronics store with your card. Ask them straight away if they want to split it into installments, or automatically “re-route” the amount to your buy-now-pay-later product.

Another example. It’s your customer’s third day abroad and his currency account is running low? Send a display notification suggesting currency exchange – or even process one automatically if the customer has chosen such an option earlier.

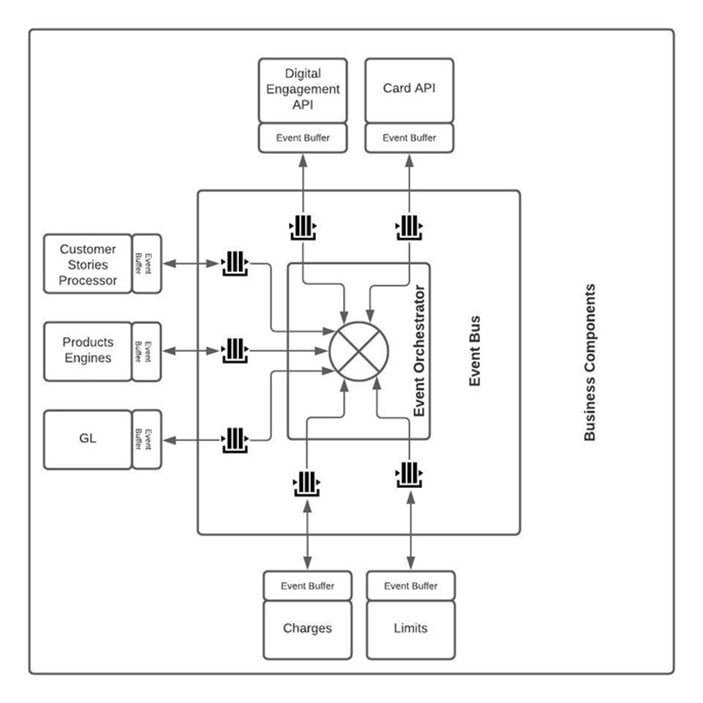

The central element of BOS’s event architecture is the Event Driven Orchestrator.

Event-Driven Orchestrator (EDO) is a component that allows you to manage communication between solution components in a distributed environment, based on events while maintaining the transactionality of financial operations. The basic task of the Event-Driven Orchestrator is to organize the distribution of messages using the Event BUS. A message should be understood as events with a defined information scope, allowing for their interpretation by the receiving systems.

There were three basic assumptions underlying the design of the Event-Driven Orchestrator, i.e.:

![]() Certainty of delivery of the event to recipients

Certainty of delivery of the event to recipients

![]() Possibility to design message distribution paths

Possibility to design message distribution paths

![]() Information about how the message was processed by event recipients

Information about how the message was processed by event recipients

Based on the above requirements, the solution architecture presented below was adopted:

Main architecture components:

![]() Event Orchestrator – a component enabling the implementation of event distribution processes along with the definition of dependencies between generated events.

Event Orchestrator – a component enabling the implementation of event distribution processes along with the definition of dependencies between generated events.

![]() Event Bus – a set of queues based on Kafka technology, allowing for asynchronous exchange of messages.

Event Bus – a set of queues based on Kafka technology, allowing for asynchronous exchange of messages.

![]() Event Buffer – a component built into business microservices that ensures transactional message exchange and allows managing business event processing in the business microservice. When connecting external loads, this component is not required.

Event Buffer – a component built into business microservices that ensures transactional message exchange and allows managing business event processing in the business microservice. When connecting external loads, this component is not required.

EDA – functional advantages

The adopted event communication allows you to build internal data flow processes, manage the information content of transmitted events in the system and allows for easy integration of processes taking place in the system with external systems. Basing communication on events initiated externally or by internal system components allows the Bank to easily build interactions with the Customer when using the product in the system, including the Customer in the decision-making and information process.

Event product processing in the system allows for the decomposition of a monolithic product processing model. As a result, the product processing process was divided into defined permissible business events on the product. This allows for clear observation of the processing of individual events, allows for easy definition of new events without affecting other tasks, and also allows for modeling the product processing process based on defined business functionalities.

The introduction of event-based product processing allowed for the free creation of financial products based on a predefined set of available events or on the basis of self-implemented events.

The concept based on the Event Driven Product Engine with a predefined set of events (tasks) allows the use of a uniform mechanism for defining and processing financial products for all product lines, such as:

![]() Loans

Loans

![]() Deposits

Deposits

![]() Current Accounts

Current Accounts

Another important feature of the solution is the autonomy and independence of the components, as a result, the modules supporting the representation of a client, account, client group, limit, product, transaction, fees and commissions, loans, deposits, accounting, affiliate programs, etc., are completely independent modules and may also be independently as part of processes based on other Core solutions. The physical separation of components and ease of integration allows for their independent development, testing, as well as replacing them with currently used business solutions.

Use of EDA by famous brands

Event- driven architecture is also often used in other industries. Let’s look at selected examples of its use in industries such as e-commerce or media.

X (ex-Twitter)

X (ex-Twitter) uses an event architecture to send messages between users. Each message is represented by an event that is forwarded to all interested systems, such as message processing systems, data analysis systems and notification systems.

Netflix

Netflix uses event architecture to manage video content. Each event, such as the start of a video or the end of a video, is communicated to all interested systems such as playback systems, recommendation systems, and analytics systems.

Amazon

Amazon uses event architecture to manage its supply chain. Each event, such as accepting an order or sending a shipment, is transmitted to all interested systems, such as accounting systems, logistics systems and customer service systems.

| If you are interested in EDA and want to see how it is used in the banking system in practice, schedule a call with our expert. |

10 top core banking solutions in 2023

In the rapidly evolving landscape of banking technology, core banking software serves as the foundation for financial institutions' operations. It is the engine that powers banks, credit unions, and other financial organizations, allowing them to manage customer accounts, process transactions, and provide a wide range of financial services. As of 2023, several core banking software providers stand out, each offering unique features and benefits. In this article, we will explore what core banking software is, its key characteristics, the advantages it offers to clients, and a detailed look at the top providers in 2023.

Understanding core banking software

Core banking software is the central nervous system of any financial institution. It is a comprehensive and integrated software solution that manages all of a bank's essential functions, from customer accounts and deposits to loans and transactions. This software ensures that a bank's operations run efficiently, securely, and in compliance with regulatory standards. In recent years, the core banking software market has seen significant growth, as banks and financial institutions look to modernize their systems and improve efficiency.

Key characteristics of core banking software

![]() Centralization:

Centralization:

Core banking systems consolidate all banking operations into a single platform, eliminating the need for disparate, disconnected systems.

![]() Real-time Processing:

Real-time Processing:

They support real-time transaction processing, ensuring that customer transactions are updated instantly.

![]() Scalability:

Scalability:

Core banking software is designed to scale with a bank's growth, accommodating increased customer volumes and new products and services.

![]() Security:

Security:

These systems prioritize data security and compliance with regulatory standards to protect customer information.

![]() Integration:

Integration:

They seamlessly integrate with various channels, such as mobile apps, online banking, ATMs, and more, offering customers a unified experience.

Benefits of core banking systems for clients

Financial institutions that adopt core banking systems can enjoy a multitude of benefits, ultimately leading to improved services for their clients:

![]() Enhanced Customer Experience:

Enhanced Customer Experience:

Core banking software empowers banks to offer innovative services such as mobile banking, online account management, and personalized financial products. This results in an enriched customer experience.

![]() Operational Efficiency:

Operational Efficiency:

Automation of processes within core banking systems reduces manual work, leading to operational efficiency and cost savings. These savings can be passed on to customers in the form of better rates and lower fees.

![]() Real-time Transactions:

Real-time Transactions:

Clients can perform real-time transactions, check balances, and receive immediate updates on their accounts, providing them with greater control over their finances.

![]() Comprehensive Services:

Comprehensive Services:

Core banking systems enable banks to offer a wide range of services, including loans, deposits, wealth management, and more, all from a single platform.

![]() Data Security: Enhanced security measures protect customer data, reducing the risk of fraud and data breaches, which can be reassuring to clients.

Data Security: Enhanced security measures protect customer data, reducing the risk of fraud and data breaches, which can be reassuring to clients.

Now, let's delve into the top core banking software providers in 2023, highlighting their unique features, advantages, and drawbacks.

Core banking software list for 2023

1. Mambu

Mambu is a cloud-based banking platform that enables banks to launch and manage digital banking products and services. It was founded in 2011. Mambu offers a range of features, including account opening, payments, lending, and risk management.

Features of Mambu Core Banking System:

![]() composable banking platform,

composable banking platform,

![]() loan origination and deposit management capabilities,

loan origination and deposit management capabilities,

![]() customer relationship management tools.

customer relationship management tools.

Pros:

![]() flexible and customizable,

flexible and customizable,

![]() enables quick product launches,

enables quick product launches,

![]() scalable for institutions of all sizes.

scalable for institutions of all sizes.

Cons:

![]() customization may require high technical expertise,

customization may require high technical expertise,

![]() costs can vary depending on the level of customization and usage,

costs can vary depending on the level of customization and usage,

![]()

customization can lead to higher costs.

2. Thought Machine

Vault by Thought Machine is a cloud-native core banking system that helps banks to modernize their IT infrastructure. It was founded in 2014. Vault offers a modular architecture that can be tailored to the specific needs of a bank.

Features of Thought Machine Vault:

![]() scalable core banking platform,

scalable core banking platform,

![]() focus on scalability and security,

focus on scalability and security,

![]() advanced principles of modern engineering.

advanced principles of modern engineering.

Pros:

![]() high scalability to accommodate growth,

high scalability to accommodate growth,

![]() secure and modern architecture.

secure and modern architecture.

Cons:

![]() implementation may require a learning curve,

implementation may require a learning curve,

![]() costs can increase with extensive customization,

costs can increase with extensive customization,

![]()

customization can lead to higher costs.

3. BOS by INCAT– pioneering the future of core banking

Founded in 2015 BOS is a leading core banking software for small and medium financial institutions. BOS stands out as a trailblazer, setting new standards for the industry. This all-in-one core system has emerged as one of the most significant and influential platforms for financial institutions in 2023.

BOS empowers leading European and international fintechs and digital banks (such as ZEN.com or Payman Group) and it is the main IT engine for global financial institutions from e.g. Saudi Arabia, Belgium, Poland, Lithuania, Bulgaria or Hungary. INCAT, the system provider, was awarded with Forbes Diamond 2023, Fintech Insurtech Awards 2021, Technology Leader 2021 and was also on the short list of the Banking Tech Awards by the Fintech Futures publishing house.

BOS' competitive advantages:

![]() cloud native and cloud-agnostic nature (can be embedded on any cloud)

cloud native and cloud-agnostic nature (can be embedded on any cloud)

![]() event-driven architecture (every customer's action in the system is an event)

event-driven architecture (every customer's action in the system is an event)

![]()

based on 40+ microservices,

![]()

open-sources technologies,

![]() high standards of security,

high standards of security,

![]() zero downtime deployment.

zero downtime deployment.

Pros:

![]() tailored for fintechs and digital banks,

tailored for fintechs and digital banks,

![]() affordable pricing (available as a SaaS or a license),

affordable pricing (available as a SaaS or a license),

![]() fully scalable (grows with your organization thanks to the concept of business lines),

fully scalable (grows with your organization thanks to the concept of business lines),

![]() easily integrated (thanks to Open API),

easily integrated (thanks to Open API),

![]() high customer satisfaction ratings.

high customer satisfaction ratings.

Cons:

![]() dedicated to small and medium-sized financial institutions,

dedicated to small and medium-sized financial institutions,

![]() limited possibilities (e.g. no solutions for building mortgage products)

limited possibilities (e.g. no solutions for building mortgage products)

Contact us to learn more about BOS >>

4. Advapay

Advapay is a cloud-based payments platform that enables banks to process payments. It was founded in 2015 and offers a variety of payment processing options, including credit cards, debit cards, and e-wallets.

Features of Advapay:

![]() modular solutions for digital banking,

modular solutions for digital banking,

![]() compliance and risk management tools,

compliance and risk management tools,

![]() tailored for payment institutions.

tailored for payment institutions.

Pros:

![]() modular approach for tailored solutions,

modular approach for tailored solutions,

![]()

focus on compliance and risk management,

Cons:

![]() may not be suitable for traditional banking institutions,

may not be suitable for traditional banking institutions,

![]() customization can lead to higher costs,

customization can lead to higher costs,

![]() may not be suitable for large financial institutions.

may not be suitable for large financial institutions.

5. Finastra

Finastra is a financial technology company that provides software and services to banks and other financial institutions. It was founded in 2015 through the merger of Misys and D+H.

Features of Finastra:

![]() wide range of banking software, including retail and corporate banking,

wide range of banking software, including retail and corporate banking,

![]() solutions for banks of all sizes,

solutions for banks of all sizes,

![]() focus on modernizing banking operations.

focus on modernizing banking operations.

Pros:

![]() comprehensive suite of banking software,

comprehensive suite of banking software,

![]() tailored solutions for various banking segments,

tailored solutions for various banking segments,

![]() assistance in the modernization of operations.

assistance in the modernization of operations.

Cons:

![]()

costs may vary based on the extent of customization.

![]()

integration challenges in complex IT environments.

Other providers:

6. Infosys Finacle

Infosys Finacle is a cloud-based core banking system that is designed to be scalable and flexible. It is offered by Infosys, a global technology company that was founded in 1981. Infosys Finacle has over 2,000 customers worldwide, including banks in emerging markets. Infosys Finacle is a popular choice for banks in emerging markets because it is scalable and flexible, and it offers a wide range of features and functionality. It is also a good choice for banks that are looking to adopt new technologies, such as cloud computing or artificial intelligence.

7. Oracle Flexcube

FLEXCUBE is an automated universal core banking software developed and introduced by Oracle Financial Services. This solution is designed for financial organizations and banks. It offers customer-centric core banking functionalities. It ensures a holistic view of all customers and enhanced communication between bank employees and consumers.

8. nCino

Launched in 2012, nCino offers a cloud-based bank operating system created by bankers for bankers. The system helps increase profitability, productivity gains, regulatory compliance, and operational transparency at all organizational levels as well as across all lines of business. Following a process structure similar to a bank’s loan accounting system, this bank operating system offers combined services through its business process management, loan lifecycle, business intelligence, and document management solutions.

9. Backbase

Backbase was founded in 2003 and provides all the building blocks banks need to fast- track the implementation of their next-generation digital banking vision. The platform enables banks to create and manage seamless customer experiences across any device that's directly integrated with any back-end system. Superior digital experiences are essential to staying relevant to consumers, and Backbase enables financial companies to rapidly grow their digital business.

10. Temenos T24

Temenos T24 is a modular core banking system that is designed to meet the needs of banks of all sizes. Founded in 1993, Temenos T24 has over 2,500 customers worldwide, including banks in Europe, the Middle East, and Africa.

Temenos T24 is a modular core banking system that is designed to meet the needs of banks of all sizes. Founded in 1993, Temenos T24 has over 2,500 customers worldwide, including banks in Europe, the Middle East, and Africa.

13 must-see movies and series about banking and finance you cannot miss

Movies and television series have the incredible power to not only entertain but also educate and inform. When it comes to banking and finance, there are several captivating films and TV shows that delve into the high-stakes world of money, investments, and financial intrigue. Whether you're a finance enthusiast or just looking for some gripping entertainment, here are 10 must-see movies and series about banking and finance. The list was prepared as part of our new series "BOS4Friday"

1. Wolf from Wall Street

We couldn't open our list with a movie other than this one. The Wolf of Wall Street was hard not to hear without even having a chance to watch it. The 2013 biographical film about the life of a stockbroker - Jordan Belfort - is a crazy story of big money, the road to the top and risky balancing on the verge of legality.

The director, Martin Scorsese, tells the true story of one of Wall Street's most controversial heroes. Jordan Belfort was a golden child of the financial world who achieved a stunning financial success thanks to the sale of bogus stocks on the American stock exchange. Quick and tremendous success brought him fortune, power and a sense of impunity, which consequently led Belfort to a spectacular fall. The Wolf of Wall Street is a must-see for anyone who wants to see the American dream in the tough financial world.

Trailer:

2. Billions (2016-)

A series about the district attorney's fight with the boss of a hedge fund, dealing with not entirely legal financial practices. Billions is a great story about a clash of two strong personalities, tremendous cunning and an even greater ego. The background to this clash is the world of hedge funds, big money, complicated relationships and impressive manipulations.

Trailer:

https://www.youtube.com/watch?v=_raEUMLL-ZI

3. Wall Street (1987)

Even though Wall Street is a 1987 movie, it is still an excellent movie to watch. It is a story about a young and ambitious stockbroker who falls under the wing of a ruthless and calculating financier, Gordon Gekko. The fascination with the rich financial shark makes the hero ready to push the boundaries of morality and do everything to achieve success comparable to that of his mentor.

Trailer:

https://www.youtube.com/watch?v=7b4BcbhGggM

4. The Big Short (2015)

A star cast, a true story and an original script - this is a recipe for success that the creators of The Big Short used. The film tells about the causes of the financial crisis of 2007-2008, caused by the bursting of the so-called credit bubble. The story is known as the "Economy for Newbies", because it explains the meanders and intricacies of the global financial market in a simple and interesting way. Well-drawn characters, pictures that you cannot take your eyes off of and original dialogues are the greatest strength of this film.

Trailer:

https://www.youtube.com/watch?v=vgqG3ITMv1Q

5. Chasing Madoff

A movie presenting the story of Bernard Madoff, an American stock market investor, owner of one of the largest financial companies on Wall Street in New York, who was arrested on December 11, 2008 and sentenced to 150 years in prison six months later, for extorting $ 65 billion from clients of investment funds linked to his business. Madoff tempted investors with huge profits that were not really there.

Bernard Madoff, recognized as the creator of the largest financial pyramid in history, died in early 2021.

Trailer:

https://www.youtube.com/watch?v=rpH_NNjModY&t=69s

6. Inside Job (2010)

Another story of the world crisis of 2018, this time through the eyes of documentary filmmakers. The Oscar-winning film is a film material documenting the shocking truth behind the scenes of the economic crisis in 2008. Through extensive in-depth research and interviews with major financial market players, politicians and journalists, the film shows the development of speculative financial operations and the financial industry behind them.

Trailer:

7. Bad Banks (2018-2020)

Bad Banks is a German series created in cooperation with HBO, presenting the fierce rivalry of the banking and financial segment, which, six months after the Great Depression, faces the challenge of tightening regulations in the financial industry. The story is told from the perspective of the main character, an ambitious employee who starts working in a prestigious position in one of Frankfurt's banks and has to face the dark side of the financial world.

Trailer:

https://www.youtube.com/watch?v=N3uLkyboKTk

8. Margin Call

A story about the first 24 hours of the financial crisis on Wall Street and the backstage of events that changed the world. The great role of Kevin Spacey, as an analyst working for a powerful investment company based on the famous Wall Street. The action of the film takes place over 24 hours and focuses on the actions taken by key employees of a large investment bank in the face of financial collapse.

Trailer:

https://www.youtube.com/watch?v=IjZ-ke1kJrA

9. Inside the Federal Reserve

Another document you can watch on Youtube. The film reveals the backstage of the world's largest "bank" - the US Federal Reserve Bank. Each of his sneezes has an immediate impact on the condition of other financial institutions, which is fascinating in itself. The film shows just how powerful the US dollar is and how America's largest financial institution impacts the rest of the world.

Full document:

https://www.youtube.com/watch?v=wq9ENxdLgVc

10. Too Big to Fail

HBO's fact-based production drama tells the story of the causes of the 2008 economic crisis and the background behind the introduction of the Paulson Plan, the US financial rescue program. The video shows in detail the actions taken by the team of the US Treasury Secretary to rescue failing investment banks. The film focuses on the changing strategies of Paulson's team and on negotiations with the CEOs of the largest US banks.

Trailer:

https://www.youtube.com/watch?v=HIOLWBD_g1o

11. Startup (2016-2018)

This TV series explores the intersection of finance and technology in the world of cryptocurrency startups. It follows a group of entrepreneurs, a corrupt FBI agent, and a gang lord, all interconnected through the pursuit of wealth and power.

Trailer:

12. "The Accountant" (2016)

"The Accountant" is a thriller starring Ben Affleck as a math savant who works as a freelance accountant for some of the world's most dangerous criminal organizations. The film combines elements of finance, action, and intrigue.

Trailer:

... and last but not least ....

13. "Money Heist" (La Casa de Papel) (2017-present)

While not a traditional finance series, "Money Heist" has gained international acclaim for its intricate heists and the manipulation of the Spanish Mint's money supply. It's a thrilling and suspenseful series that combines action with elements of economic strategy.

Trailer:

These movies and series offer a captivating look into the world of banking, finance, and the dynamics of money. Whether you're interested in financial crises, the stock market, or the pursuit of wealth, there's something on this list for everyone. So, grab your popcorn and prepare to be both entertained and enlightened by these must-see titles. Enjoy!

INCAT joins the Bulgarian Fintech Association

Sofia, Bulgaria – August 31, 2023 – INCAT Ltd. - the provider of a cloud-native and fully flexible BOS core banking system, has joined the Bulgarian Fintech Association (BFA). The association is the leading voice for the fintech industry in Bulgaria, and INCAT’s membership is a testament to the company’s commitment to the Bulgarian market.

We are excited to join the BFA and become a part of the growing fintech community in Bulgaria.

- said Piotr Hanusiak, CEO of INCAT.

We believe that the BFA is a valuable resource for our company, and we look forward to working with other members to advance the fintech industry in Bulgaria.

Piotr Hanusiak emphasizes the importance of the Bulgarian market for the growth of the company. INCAT is in the process of the first implementations of its system for clients from Bulgaria, and it also works for clients from the entire region. BOS drives leading fintech projects in Lithuania and Hungary as well.

We are pleased to welcome INCAT to the BFA.

- said Valeri Valtchev, Co-founder and Chairman of the BFA.

INCAT is a fast-growing provider of core banking solutions for modern fintechs and digital banks, and its membership is a valuable addition to our association.

We look forward to working with INCAT to promote innovation and growth in the Bulgarian fintech industry.

INCAT’s core banking system, BOS, is a comprehensive solution that provides modern financial organizations such as fintechs and neo banks with the tools they need to succeed in today’s digital age. The company's solutions help to create unrivaled financial products, as well as improve efficiency, reduce costs, and provide better customer service. More: www.incat.eu

The BFA is a non-profit organization that represents the interests of the fintech industry in Bulgaria. The association promotes the development of fintech, provides education and training, and advocates for public policy that supports the industry. More: www.fintechbulgaria.org

16 women who changed IT history

Although women are increasingly choosing to work in IT, the statistics are still inexorable. According to a report by the 'Carrots Foundation', women account for only 30% of the IT industry, and it does not look like this trend will change any time soon.

Yet it was women who laid the foundations for the current shape of technology and made the discoveries that still influence the IT world today. For this reason, we have compiled a list of women who have had a significant impact on the development of the IT industry and who, through their stories, inspire and show that technology is not an exclusively male domain.

Women in IT - the most famous names and their achievements

Computer science is a scientific discipline that is probably associated by most of us as one that has basically always been dominated by men. There is nothing surprising in such a perception, as this is indeed the case, as confirmed by cyclical studies conducted all over the world. Women in IT, although relatively few in number, nevertheless play very important roles in some cases. There is no shortage of female software authors, engineers or game developers among them, although the popularity of their names certainly remains incomparably lower than that of Steve Jobs or Bill Gates. In order to change this, today we have decided to remind you of the most important - in our opinion - women who, thanks to their achievements, have made a name for themselves in the world of IT, in some cases significantly influencing its development. At the same time, we hope that, as a result, in some time we will be able to present again other well-known women in IT and their achievements, confirming the thesis that gender does not matter much when it comes to the ability to perform complex operations using computers and increasingly advanced technologies. So, if you are a woman and have so far wondered whether you should tie your career and future to IT, having an aptitude for it, the profiles below should allow you to effectively dispel your doubts.

Women have played an important role in the field of computing and information technology, developing some of the most important elements of modern IT.

Meet 16 exceptional women who changed the history of the IT industry once and for all.

![]() Ada Lovelace - pioneer of programming

Ada Lovelace - pioneer of programming

London-born Lady Ada Lovelace (1815-1852), although the daughter of the poet Lord George Byron, had a passion and gift for mathematics from an early age.

London-born Lady Ada Lovelace (1815-1852), although the daughter of the poet Lord George Byron, had a passion and gift for mathematics from an early age.

She is recognized as the world's first computer programmer because she developed a way in which a machine called an analytical engine could perform calculations. This machine, invented by her friend, mathematician and inventor Charles Babbage, is considered the first universal computer.

Lovelace created an algorithm that was soon recognized as the world's first computer program, and it is still used in the creation of today's applications.

![]() Edith Clarke - the first female engineer

Edith Clarke - the first female engineer

"I always wanted to be an engineer, but I thought women shouldn't go into things like engineering studies." - claimed Edith Clarke and...she was sorely mistaken, for a dozen years after that statement she became the world's first ever female electrical engineer.

"I always wanted to be an engineer, but I thought women shouldn't go into things like engineering studies." - claimed Edith Clarke and...she was sorely mistaken, for a dozen years after that statement she became the world's first ever female electrical engineer.

Edith Clarke received a small inheritance at the age of 18, which put her through Vassar College, then a sister institution of Yale; she graduated in 1908. She soon began working full-time as manager of the all-female 'human computers' team at AT&T.

Determined to further her career by doing what 'women should not do', she then enrolled at MIT and became the first woman of that institution to earn a master's degree in electrical engineering. But even with her achievements to date, no technology company wanted to hire her as a female engineer. As a result, Clarke left the US to teach physics at the Women's College in Istanbul. However, she did not give up on her dream of a career in engineering and returned to the US after a few years to work for General Electric, which allowed her to achieve her desired goal. At General Electric, Clarke created and patented The Clarke Calculator, a graphical device that solves equations used to transmit electricity over transmission lines longer than 250 meters. Her huge contribution to intercontinental telephone communications silenced the skeptics; in 1922, at the age of 38, Edith Clarke became the first professional electrical engineer.

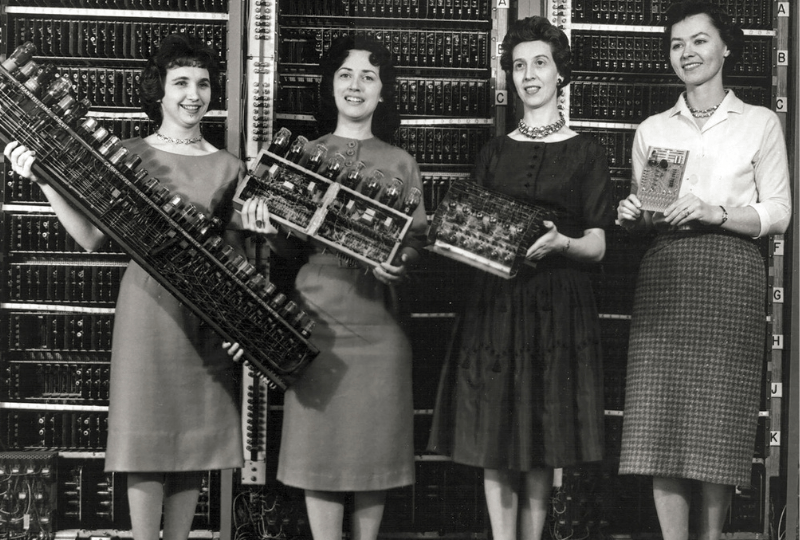

![]() The ENIAC women: pioneers of computing

The ENIAC women: pioneers of computing

In 1946, on the eve of its debut, the world's first general purpose computer failed. As a result, seven women engineers were delegated to rescue the project and had one night to fix the device called ENIAC (Electronic Numerical Integrator And Computer), which was the ancestor of today's computers. These women included:

In 1946, on the eve of its debut, the world's first general purpose computer failed. As a result, seven women engineers were delegated to rescue the project and had one night to fix the device called ENIAC (Electronic Numerical Integrator And Computer), which was the ancestor of today's computers. These women included:

![]() Betty Jean Jennings Bartik,

Betty Jean Jennings Bartik,

![]() Kathleen McNulty,

Kathleen McNulty,

![]() Mauchly Antonelli,

Mauchly Antonelli,

![]() Ruth Lichterman Teitelbaum,

Ruth Lichterman Teitelbaum,

![]() Frances Bilas Spence,

Frances Bilas Spence,

![]() Marlyn Wescoff Meltzer,

Marlyn Wescoff Meltzer,

![]() Frances Snyder Holberton.

Frances Snyder Holberton.

The system was neither small nor simple, weighing 30 tonnes and covering 140 square metres. It was equipped with 18,000 vacuum tubes, 70,000 resistors, 10,000 capacitors and 5 million hand-soldered connectors. Given its ability to calculate ballistic trajectories, the need for it to work was great - the US was then plunged deep into World War II.

Unfortunately, although the project succeeded, the ENIAC heroines, did not receive the recognition they deserved for quite some time. It was only in 1997 that they were inducted into the Women in Technology International (WITI) Hall of Fame. In 2014, Walter Isaacson, in his book Innovators, juxtaposed the ENIAC Seven with the likes of Steve Jobs and Nikola Tesla, and a few years ago, a documentary film entitled The Eniac Programmers Project was released, detailing how women came up with the way to program the machine.

![]() Grace Hooper - bug expert

Grace Hooper - bug expert

American Grace Hopper (1906-1992) was an admiral in the US Navy and one of the first programmers of the Mark 1 mechatronic calculator, the prototype of today's computers, used in World War II operations. She also created a 500-page textbook detailing the basic principles of computer machines. But this is not the end of her contribution to the IT industry.

American Grace Hopper (1906-1992) was an admiral in the US Navy and one of the first programmers of the Mark 1 mechatronic calculator, the prototype of today's computers, used in World War II operations. She also created a 500-page textbook detailing the basic principles of computer machines. But this is not the end of her contribution to the IT industry.

Hopper and her team created the first ever computer compiler, which became the precursor to the COBOL (Common Business Oriented Language) programming language. It was not long before COBOL was to prove to be one of the most widely used languages in the world of IT, and although today some experts consider it to be obsolete, it is still being used.

Grace Hopper was the first to introduce the term 'bug', for bugs in code. It is related to an anecdote that a moth once flew into the hardware on which Hooper was working and caused a short circuit. Since then, Hopper has popularised the term 'computer bug' (bug in English is a bug), which refers to a computer program error.

![]() Margaret Hamilton - programming for NASA

Margaret Hamilton - programming for NASA

Margaret Hamilton is an American programmer, systems engineer and founder of two technology companies who spent years designing NASA systems.

Margaret Hamilton is an American programmer, systems engineer and founder of two technology companies who spent years designing NASA systems.

She was director of software engineering at the MIT Instrumentation Laboratory, which created the onboard flight software that enabled Neil Armstrong and Buzz Aldrin's Apollo missions. On 22 November 2016, Hamilton received the Presidential Medal of Freedom from President Barack Obama for her work on NASA's Apollo moon missions.

![]() Sister Mary Kenneth Keller - the first woman with a PhD in computer science

Sister Mary Kenneth Keller - the first woman with a PhD in computer science

The first woman to receive a PhD in computer science was a nun: Mary Kenneth Keller entered the 'Sisters of Charity' in 1932, taking her vows in 1940. Keller earned a master's degree in mathematics from DePaul University in Chicago and studied briefly at Dartmouth. There she was instrumental in developing a key computer language: a universal symbolic instruction code for beginners called BASIC.

The first woman to receive a PhD in computer science was a nun: Mary Kenneth Keller entered the 'Sisters of Charity' in 1932, taking her vows in 1940. Keller earned a master's degree in mathematics from DePaul University in Chicago and studied briefly at Dartmouth. There she was instrumental in developing a key computer language: a universal symbolic instruction code for beginners called BASIC.

With BASIC, writing software was no longer restricted to mathematicians and scientists. Her contributions made computer use much more accessible to the wider population. Keller returned to the Midwest and earned a PhD from the University of Wisconsin in 1965, and then headed the computer science department at Clarke College in Iowa, where she worked for the next 20 years.

![]() Susan Kare - the Steve Jobs discovery

Susan Kare - the Steve Jobs discovery

Although Susan Kare worked for Microsoft early in her career, her greatest achievements came when she worked with Steve Jobs at Apple.

Although Susan Kare worked for Microsoft early in her career, her greatest achievements came when she worked with Steve Jobs at Apple.

Kare dreamt of a career as an artist and, after finishing school, came to San Francisco to find her opportunity. A chance meeting with an old high school friend led to an interview for a job at Apple. Steve Jobs, inspired by Xerox's graphical user interface (GUI), was looking for an artist to design Macintosh icons. Kare's designs appealed to Jobs enough that he decided to work with her.

Using a block of millimetre paper, Kare therefore designed icons for the Mac that met three principles: they were simple, elegant and understandable. As part of her work at Apple, Susan also created the Chicago typeface, used on the first four generations of the iPod. Kare's designs were even executed with Jobs' obsessive and characteristic attention to detail, which incidentally still defines Apple today.

![]() Carol Shaw - Atari developer

Carol Shaw - Atari developer

Carol Shaw was born and raised in Palo Alto, California. Although she excelled in mathematics from the start, it wasn't until she inherited a model electric train from her brothers that Shaw started tinkering with electronics.

Carol Shaw was born and raised in Palo Alto, California. Although she excelled in mathematics from the start, it wasn't until she inherited a model electric train from her brothers that Shaw started tinkering with electronics.

After graduating from Berkeley's computer science graduate program, Shaw accepted a position at the Atari game company in the late 1970s. Wearing thick-rimmed glasses and an immortal flannel shirt, she began designing and programming video games. Shaw programmed one of Atari's most famous shooters, River Raid, which was voted the best wargame of 1984, and Shaw's work as a pioneering game designer made her a legend for two generations of gamers.

![]() Adele Goldberg - pioneer of the UI

Adele Goldberg - pioneer of the UI

Without Adele Goldberg, the Apple desktop would look very different today. Working at Xerox Palo Alto Research Center (PARC), Adele was the only woman in the group that created Smalltalk-80, one of the most popular and influential early programming languages.

Without Adele Goldberg, the Apple desktop would look very different today. Working at Xerox Palo Alto Research Center (PARC), Adele was the only woman in the group that created Smalltalk-80, one of the most popular and influential early programming languages.

She also introduced Smalltalk to Steve Jobs, who implemented a lot of the language's concepts in Apple's first products.

Beyond Apple, many modern graphical user interfaces (GUIs) have design standards that relate directly to Goldberg's original work.

![]() Radia Perlman - "Don't call me the mother of the internet".

Radia Perlman - "Don't call me the mother of the internet".

Radia Perlman is considered by many to be the founder of the Internet, although she strongly denies this, insisting that "the Internet was not invented by one person". What is certain, however, is that it was Perlman who created the algorithm behind the Spanning Tree Protocol (STP), which is a vital part of the foundations of the Internet.

Radia Perlman is considered by many to be the founder of the Internet, although she strongly denies this, insisting that "the Internet was not invented by one person". What is certain, however, is that it was Perlman who created the algorithm behind the Spanning Tree Protocol (STP), which is a vital part of the foundations of the Internet.

Perlman was one of only a handful of women who began her research career at MIT, where she published her textbook Interconnection in 2000, greatly simplifying network routing and bridging. "My book created order," she later said.

Despite her individual successes, notably the creation of the STP protocol, Perlman emphasises the importance of teamwork in technology development and does not want to focus solely on her achievements.

There are, of course, many more women who have made significant contributions to the development of technology, but we have selected profiles of these ten who, over the years, have proven that they can blaze trails in various areas of IT and are not afraid of the challenges of creating modern IT solutions. We wish all women who have aspirations to enter the IT industry not to hesitate and try their hand at it, following the example of the heroines of our article.

Cybersecurity in core banking systems: ensuring digital transformation with BOS

In today's digital era, where financial services are increasingly moving towards online platforms, cybersecurity plays a critical role in safeguarding sensitive customer data and ensuring the integrity of core banking systems. As organizations embrace digital transformation, it is imperative to adopt robust cybersecurity measures to protect against evolving cyber threats.

Importance of cyberse2curity in core banking systems

Core banking systems serve as the backbone of financial institutions, managing critical operations such as account management, transactions, and customer information.

With the rise in cyber-attacks targeting financial institutions, robust cybersecurity measures are essential to safeguard against data breaches, financial fraud, and reputational damage. A comprehensive cybersecurity framework is necessary to protect core banking systems from both external and internal threats, ensuring the confidentiality, integrity, and availability of sensitive data.

Key Cybersecurity Challenges in Core Banking Systems

Today's banking systems, especially core banking systems, face a range of risks and challenges in the area of cybersecurity, including:

![]() Data breaches

Data breaches

Cybercriminals continuously target financial institutions to gain unauthorized access to customer data, leading to identity theft, financial loss, and legal implications.

![]() Advanced Persistent Threats (APTs)

Advanced Persistent Threats (APTs)

APTs are sophisticated attacks that aim to breach security defenses and gain prolonged access to the core banking systems, potentially causing significant damage.

![]() Insider threats

Insider threats

Internal employees with privileged access can pose a significant risk to core banking systems by intentionally or inadvertently compromising sensitive data.

![]() Regulatory compliance

Regulatory compliance

Financial institutions must adhere to stringent regulatory requirements, such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS). Compliance with these regulations is crucial to avoid penalties and maintain customer trust.

BOS approach to cybersecurity

A fully flexible and scalable BOS system lives as much as the best financial safety standards. It’s additionally compliant with the maximum crucial enterprise requirements, as tested and confident through an outside certification body. Here’s how BOS makes it:

![]() Certified practices:

Certified practices:

As a BOS provider, INCAT maintains an Information Security Management System (ISMS) in accordance with ISO/IEC 27001 to proactively manage information security risks and verify the effectiveness of technical and organizational controls through internal and external audits.

![]() Vulnerability Management

Vulnerability Management

As part of Vulnerability management, we run activities such as vulnerability scanning or security patch management, which we perform not only at the BOS level, but also at the level of supporting services. Thanks to this, we are aware of the existence of vulnerabilities not only in our product but in the entire system where BOS operates. This in turn enables us to implement the entire process in accordance with the principles of continuous risk management.

![]() Secure Infrastructure

Secure Infrastructure

BOS core banking systems are built on a secure cloud infrastructure, leveraging industry-leading security protocols and encryption standards to protect customer data. Cloud infrastructure facilitates the use of security against cyberattacks - DDOS attacks, detection of intruders, or behavioral anomalies. The cloud makes it easier to resist such attacks.

![]() Continuous Monitoring

Continuous Monitoring

BOS employs real-time monitoring and threat intelligence to detect and respond to potential cyber threats promptly. Monitoring solution leverages advanced analytics and machine learning to identify anomalies and proactively mitigate risks. We use the SIEM Security Information and Event Management system for monitoring.

![]() Access Controls

Access Controls

BOS implements strong access controls, including multi-factor authentication and Role - Based Access Control (RBAC), to ensure that only authorized personnel can access sensitive data and functionalities within the core banking systems.

In the realm of core banking systems, cybersecurity is of paramount importance to protect sensitive data, maintain operational continuity, and uphold customer trust.

BOS's approach to cybersecurity encompasses a range of measures aimed at preventing, detecting, and responding to cyber threats. By adopting a comprehensive cybersecurity framework, organizations can leverage the benefits of digital transformation while safeguarding their core banking systems against evolving security risks.

Smooth Transitions: Zero Downtime Deployment for Next-Generation Core Banking Systems

In today's fast-paced banking industry, the ability to implement new versions of core banking systems without any disruptions is crucial. Financial institutions need to keep up with customer expectations, regulatory requirements, and technological advancements while ensuring continuous service availability. This challenge has led to the concept of zero downtime deployment, where upgrades, improvements, and new features are seamlessly integrated into the core banking system without causing any interruptions.

ZDD– what’s it?

Zero downtime deployment (ZDD) refers to the process of deploying new versions of a core banking system without causing any disruption to its ongoing operations. It allows financial institutions to introduce updates, improvements, and new features seamlessly while maintaining continuous service availability for customers.

In our company, we offer various capabilities and features that support zero downtime deployment. BOS's architecture is designed to ensure high availability and scalability, enabling financial institutions to implement new versions of their core banking systems smoothly. They leverage cloud-native technologies, microservices, and containerization to achieve this objective.

Rolling deployment

One of the key approaches used to implement zero downtime deployment is the concept of rolling updates (or rolling deployments) With this technique, new versions of BOS system are deployed incrementally, in small batches or segments, rather than all at once. By deploying updates in this manner, the risk of system failures or disruptions is minimized. If any issues are encountered during the deployment of a particular segment, it can be rolled back while ensuring the rest of the system remains operational.

"Despite the increasing demand for core banking system transformations, only around 30% of such transformations have successfully migrated ledgers and products to new systems, indicating the complexity involved”.

Source: McKinsey Digital

At INCAT, we provide comprehensive documentation and resources that guide financial institutions on how to achieve zero downtime deployment. By following these guidelines, financial institutions can mitigate risks and ensure a smooth transition to new versions of their core banking systems.

We also attach great importance to proper testing and monitoring during the implementation process. Thorough testing, including unit testing, integration testing, and performance testing, helps identify potential issues before they affect the live system. Continuous monitoring of the system during and after the deployment ensures early detection of any anomalies and allows for immediate remediation.

Benefits of Zero Downtime Deployment

![]() Uninterrupted Banking Services

Uninterrupted Banking Services

With ZDD, banks can update their systems, introduce new features, and fix bugs without causing disruptions to customer access or transaction processing. This ensures uninterrupted banking services, preventing any inconvenience or financial loss to customers.

![]() Seamless User Experience

Seamless User Experience

ZDD ensures a seamless user experience by eliminating any service disruptions or downtime during the deployment process. Customers can continue using the banking applications without any interruptions, accessing their accounts, making transactions, and utilizing various financial services offered by the bank.

![]() Continuous Availability

Continuous Availability

Core banking systems need to be available 24/7, as customers expect round-the-clock access to their financial services. ZDD enables continuous availability by allowing updates and changes to be deployed without affecting system uptime.

"Banks worldwide spend millions of dollars each year maintaining their core banking systems, which handle high transaction volumes and are expected to function without interruptions."

By following best practices and leveraging the resources provided by platforms like BOS financial institutions can successfully implement new versions of their core banking systems while ensuring continuous service availability for their customers.