Buy Now, Pay Later (BNPL) services have emerged as a dynamic and continually evolving financial offering, reshaping the way consumers manage their payments. Over the past few years, the BNPL landscape has witnessed remarkable growth and innovation, leading to a surge in popularity among consumers and businesses alike. In this article, we will delve into the evolution of BNPL, highlighting its sustained development and exploring the role of fundamental software solutions like BOS in the creation of innovative financial products.

BNPL, or “buy now, pay later,” is a type of loan that allows consumers to make purchases with deferred payment. Under this arrangement, the consumer receives the goods or services immediately or spreads the repayment over installments, usually at no additional cost.

BNPL started to gain significant traction in Europe during the early 2010s. The fastest growth occurred during the Covid-19 pandemic in 2020 and the trend continues. According to GlobalData, the European BNPL market alone was worth €155.79 billion in 2023 and is expected to grow to €300 billion by 2025.

BNPL is particularly popular among young consumers who value the convenience and flexibility of this solution. According to research by Kearney, in 2023 in Europe, over half (57%) of consumers aged 18-34 used BNPL.

One of the notable advantages of BNPL is that it empowers young individuals on their path to financial independence, especially when they may not yet have substantial savings but face significant purchasing needs. This flexibility offered by BNPL allows them to make essential purchases, whether it’s for education, setting up a home, or acquiring necessary items, without the immediate burden of a full upfront payment. By enabling responsible spending and budget management, BNPL serves as a valuable tool for young people navigating their financial journey.

The European BNPL market is expected to grow to €300 billion by 2025.

BNPL is mostly used for purchases in categories such as:

![]() fashion,

fashion,

![]() electronics,

electronics,

![]() services.

services.

Further places also included:

![]() Home Furnishings – BNPL is often utilized for purchasing furniture, home decor, and appliances;

Home Furnishings – BNPL is often utilized for purchasing furniture, home decor, and appliances;

![]() Beauty and Cosmetics – many users opt for BNPL when buying skincare, makeup, and beauty products;

Beauty and Cosmetics – many users opt for BNPL when buying skincare, makeup, and beauty products;

![]() Travel: some BNPL services allow users to finance plane tickets and travel expenses.

Travel: some BNPL services allow users to finance plane tickets and travel expenses.

The Buy Now, Pay Later (BNPL) market in Europe is experiencing remarkable growth, poised to become a €300 billion industry by 2025, according to projections by Deloitte. This rapid expansion is driven by:

![]() increased popularity of online shopping,

increased popularity of online shopping,

![]() a growing group of young consumers who value the convenience and flexibility of BNPL,

a growing group of young consumers who value the convenience and flexibility of BNPL,

![]() technology developments that enable BNPL integration with an increasing number of e-commerce platforms.

technology developments that enable BNPL integration with an increasing number of e-commerce platforms.

It is no wonder that with the growing popularity of BNPL solutions, there is also an increasing growth in IT systems offering tools for creating and managing BNPL solutions. One of such solutions available on the market is BOS – a fully flexible and cloud-native system. BOS incorporates a BNPL module allowing for the creation of credit products with deferred payment. Notable features include:

![]() deferred payments within limits granted by the bank,

deferred payments within limits granted by the bank,

![]() application to current and previous purchases,

application to current and previous purchases,

![]() flexibility in linking to existing accounts or as a separate product.

flexibility in linking to existing accounts or as a separate product.

BOS system incorporates a BNPL module allowing for the creation of credit products with deferred payment.

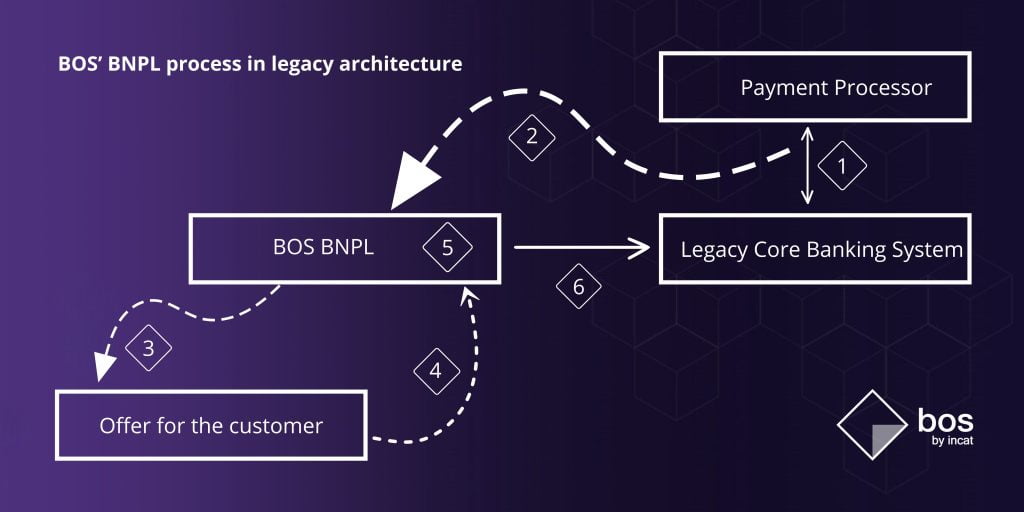

The BNPL process within BOS comprises six well-defined steps, ensuring a seamless experience for both consumers and businesses: Steps include:

1) transaction authorization,

2) verification for deferral eligibility,

3) offer presentation,

4) client acceptance,

5) micro-loan creation,

6) account funding.

The whole process looks like in the picture below:

Efficiency Consideration

While Banking Legacy Systems adeptly accommodates BNPL functionality, the question is whether BNPL should exist as a separate system arises. It’s crucial to clarify that when referring to a separate system, it pertains to a dedicated platform specifically designed for managing the intricacies of BNPL services. This is distinct from the main transactional banking system, BOS, and even more so from traditional Banking Legacy Systems.

Benefits of a Separate System for BNPL

![]() Scalability

Scalability

A dedicated BNPL system allows for focused scalability, efficiently handling the growing volume and complexity of BNPL transactions.

![]() Specialized Handling

Specialized Handling

BNPL systems can cater specifically to the unique characteristics of deferred payments, dynamic calculations, and the nuanced nature of BNPL services.

![]() Optimal Performance

Optimal Performance

Separation ensures that the BNPL system operates optimally, avoiding potential conflicts or constraints within broader banking systems.

![]() Streamlined Processes

Streamlined Processes

BNPL-centric platforms can streamline processes, enhancing efficiency and responsiveness to the evolving demands of the BNPL landscape.

***

If you want to learn more about what the BNPL solution in the BOS system offers, click the link or contact us in order to schedule a demo of the solution.